Online scams are getting smarter and causing even higher losses. In 2024 alone, people in the U.S. reported more than $12.5 billion in losses to fraud, a 25% year-over-year increase, according to the FTC. Scams now show up through email, texts, social media, phone calls, and everyday websites, making it hard to keep track of what is real and what puts your information at risk.

You should not have to be a security expert to stay safe. In this guide, we break down the most common types of scams in clear terms and help you understand what you can do to avoid them.

1. Employment Scams

Employment scams show up as fake job opportunities. Victims are often lured in by what looks like a legitimate job offer, then asked to pay money, share sensitive information, or complete tasks that benefit the scammer rather than you.

These job offers typically seem flexible, well-paid, or easy to qualify for. Employment scams may appear through unsolicited texts, WhatsApp messages, social media platforms, and even genuine job boards like LinkedIn or Upwork.

For example, you might get a text offering a remote job with high pay. The “recruiter” claims all you need to do is rate products to earn quick money. At first, you see small payouts in an online dashboard, which makes the opportunity feel real. But after building that initial trust, they claim you can unlock higher earnings by making a deposit or buying “work credits.” Once you send the money, communication stops, or the platform locks you out entirely.

These scams are rising fast. Reports to the FTC tripled from 2020 to 2024, with more than $500 million in losses last year alone.

How to Avoid It

- Never pay to get a job. Legitimate employers will never ask for money up front or require deposits to access your earnings.

- Verify the company and the recruiter. Look for a real website, clear job details, and a verifiable business email. Search the company name plus “scam” to check for warnings.

- Be skeptical of high-pay, low-effort offers. Does the job offer seem too good to be true? Then it likely is. Messages claiming you can earn quickly with no interview or experience are major red flags.

- Protect your personal information. Do not share your banking details, ID documents, or your Social Security number until you can confirm the job is real.

2. Imposter Scams

Imposter scams are a broad category of fraud where criminals pose as someone trustworthy in order to manipulate you. This may include everything from fake government officials to banks, tech support, employers, charities, or even friends and family members.

These scams are becoming more advanced as deepfake audio, AI-generated faces, and realistic digital profiles make the impersonation harder to spot. In 2024 alone, consumers lost nearly $3 billion from imposter scams.

There are several different methods to carry out an imposter scam, but the imposter strategy itself is the core deception.

3. Phishing

Phishing is the most common type of imposter scam. Cybercriminals send emails masquerading as a trusted source.

The goal is to trick you into clicking a malicious link, opening an attachment, or giving away login credentials. Phishing is one of the most common types of social-engineering scams used by hackers. The Federal Trade Commission reports that nearly 23% of all reported cyber-fraud incidents in 2024 started with a phishing attempt.

Phishing attacks often use spoofing tactics and appear as emails that look like they come from a trusted organisation.

Phishing attempts are also becoming much harder to spot. The message might use the logo of a company and lead to fake sign-in pages that closely resemble the real thing.

Phishing scams also often create a sense of urgency. This is because when you feel rushed, you are more likely to react quickly without stopping to check if the message is real. Scammers rely on that moment of stress to slip past your usual guardrails.

For example, a phishing attempt email might read:

“We detected unusual activity on your account and temporarily limited access. Please verify your identity now to restore full access. Click the link below and sign in within 24 hours to avoid account suspension.”

How to Avoid It

- Pause before clicking links or attachments. If the message claims it’s urgent, pause and type the website address yourself rather than using the link.

- Check the sender’s email address and domain carefully. A legitimate organization will use a domain you recognize (for example, @yourbank.com). If the email domain is a string of random characters or a slightly misspelled version, that’s a major red flag.

- Use multi-factor authentication (MFA). Even if a scammer manages to get your password, MFA adds another layer of protection.

- Keep your software and devices updated. Many phishing campaigns exploit outdated browsers or security software; installing updates helps remove those vulnerabilities.

4. Text Message (Smishing) Scams

Smishing is essentially a mobile version of traditional phishing. You’ll receive a text message that looks like it comes from a bank, courier, government agency, or other trusted source. The difference is that it reaches you on your phone, where shortened links and small screens make it harder to spot warning signs.

Smishing has become one of the fastest-growing scams, and targets people who handle most of their accounts and purchases on their phones. The FTC reported about $470 million in losses from text-message scams in 2024, five times the losses from 2020.

How to Avoid It

- Don’t trust links or replies in unexpected texts. If you get a message claiming urgent action (account locked, delivery failed, toll unpaid), don’t click the link or reply. Instead, open the official app or website or call the organisation using a verified number.

- Check the sender number and destination URL carefully. Legitimate companies don’t usually send generic numbers or obscure links. Be especially suspicious if the link is shortened, mismatches the brand name, or the phone number is unfamiliar.

- Treat the message like you would a phishing email. Because your phone makes it harder to inspect details, give yourself a moment to think: Why am I being contacted? Did I expect this? Is this normal for this company?

5. Debt Collection/Unpaid Toll Scams

Debt collection scams have become increasingly common in recent years, especially fake unpaid toll messages that demand immediate payment.

Text messages falsely demanding unpaid tolls have surged by over 600% in some U.S. states in 2025.

A typical message will say there is a toll charge or overdue payment linked to your vehicle or address. It will include a link to “resolve” the debt. If you click the link, you’ll be taken to a fake payment page designed to collect your card details or personal information.

Once you enter your card number, the scammer will generally try to add it to a mobile wallet such as Apple Pay or Google Wallet. They will then ask for the verification code sent to you by text. Sharing that code allows them to make purchases freely with your card details using contactless payments or online checkouts.

While unpaid toll payments are definitely the most prevalent debt collection scams currently, there are a few different types out there to look out for:

- Fake utility balances

- Student loan repayment scams

- Fake credit card debt

- Package-delivery fee scams

How to Avoid It

- Verify the claim independently. Use the official website or phone number of the agency or company to confirm if the unpaid balance is legitimate. Never use the contact information in the message.

- Do not click payment links in unexpected texts. Real toll agencies do not require immediate payment through unfamiliar portals.

- Watch for red flags. Threats of legal action, payment by gift card or crypto, spelling errors, and vague details about the debt are all signs of a scam.

- Check your own records. If a debt is real, you will likely have other online or physical documentation proving it.

6. Investment and Crypto Scams

An investment scam involves someone trying to convince you to put your money into a business, fund, or opportunity that does not actually exist. These scams often show up as “exclusive” stock tips or private funds offering “guaranteed” returns.

Scammers often use professional-looking websites, dashboards, and even fake testimonials to make the offer look legit. These scams may start with a friendly text from someone who then claims they dialed the wrong number. After casual conversations over days or weeks, they introduce a life-changing investment “opportunity” or new cryptocurrency with huge potential for returns.

The scammer will typically ask for a small initial deposit. Then, to build your confidence in the scheme, the fake investment dashboard will show your balance growing. They will then pressure you to transfer a much larger sum. Once you do, they will stop responding, and the site will likely disappear entirely.

According to the Federal Trade Commission, people reported $5.7 billion lost to investment scams in 2024, with a median loss of more than $9,000 per person.

How to Avoid It

- Verify the seller. Always check whether the person or company is registered with a reputable financial regulator such as the SEC or FINRA.

- Stay skeptical of “no-risk” returns. The reality is that every real investment carries risk. If the opportunity guarantees growth, it’s likely a scam.

- Avoid hard-to-trace payments. Do not invest through unfamiliar payment apps, prepaid cards, or wires to personal accounts.

- Watch for staged wins. If a platform shows quick, unrealistic returns after a small deposit, treat it as suspicious. Scammers often use fake gains to hook you.

- Take time to think. If an “investment advisor” pushes you to act now or discourages outside advice, it’s a major red flag.

7. Mail Fraud

Scammers are increasingly turning to your mailbox to stage fraud because physical mail carries a false sense of security. According to the Financial Crimes Enforcement Network, more than $688 million in suspicious activity was linked to mail-theft-related check fraud in a recent reporting period.

There are many different ways that a scammer may try to exploit you through the mail. But here are some of the most common things to look out for:

- Check diversion or alteration. A payment sent to you is intercepted by a scammer, who either takes the original or forges the details, diverting the funds.

- Credit-card or account-offer hijacking. A pre-approved card or offer arrives in the mail, but it’s been diverted by a scammer who uses it first or reroutes it to their control.

- Mail theft for identity theft. Scammers steal items from your mailbox, such as bank statements and tax documents, and use the information to open accounts or commit fraud in your name.

How to Avoid It

- Secure your mailbox and incoming mail. Use a locked mailbox, pick up your mail promptly, and consider using a P.O. box if you travel often.

- Shred sensitive mail you don’t need. Fraudsters can reuse bank statements, credit-card offers, and tax documents if you simply throw them away.

- Monitor your account activity regularly. If you receive an unexpected check, card offer, or notice in the mail, or if you see unfamiliar transactions, investigate them immediately.

- Report missing or misaddressed mail. If the mail you expect doesn’t arrive, or you receive someone else’s documents, report it to the United States Postal Inspection Service and your bank.

8. Romance Scams

Romance scams use emotional connections to exploit a victim’s trust. Scammers know that by establishing a feeling of intimacy, you are more likely to believe their intentions are real.

These scams can last for months or even years. They typically start with a simple conversation on a dating app or social platform and eventually evolve into a relationship that feels real.

In many cases, the scammer presents themselves as someone successful. They might post photos of luxury hotels and expensive cars to reinforce this image. Scammers use stolen photos, fake identities, and emotional manipulation to keep the scam going for as long as possible.

After nurturing the romantic relationship, the scammer will explain they are temporarily unable to access their accounts and ask for help with a sudden emergency or a short-term business setback.

Requests usually start small and then scale as you continue to send them money. For example, the first request may be something like: “I just need help covering a bill,” or “I’m trying to visit you but need help with the ticket.” Over time, the excuses will get more dramatic. For example, they may claim their bank account is frozen or that they are dealing with legal trouble.

Romance scammers will always promise to pay you back, and will guilt-trip you into sending money, insisting the relationship depends on your support.

Losses from romance scams are among the highest of any fraud category. Reported losses exceeded $1.14 billion in 2023, with many people losing thousands of dollars.

How to Avoid It

- Never send money to someone you only know online. Avoid sending money, gift cards, or crypto to someone you’ve never met, even if you believe it’s for their predicament.

- Be cautious of relationships that never move offline. If your new “partner” avoids meeting in person or via video, pause and ask questions.

- Validate the person’s identity. Do a reverse image search on their pictures, check for inconsistencies in their story, and if you are suspicious, insist on a live video call.

- Protect your personal and financial information. Never give out your account numbers, credit-card details, or Social Security number.

9. Fake Prize and Sweepstakes Scams

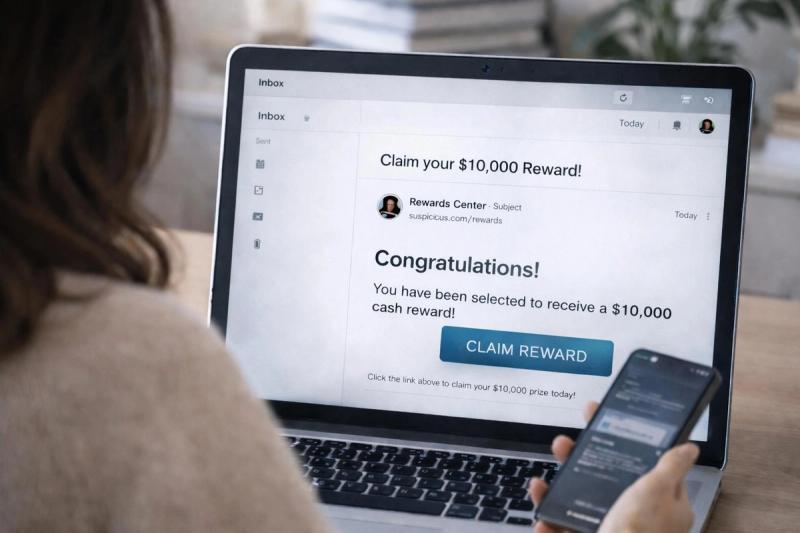

Ever received a message saying you won an amazing prize you don’t remember entering? This is a common scam. Fake prize and sweepstakes scams promise victims cash or other high-value rewards like free vacations.

These scams often use official-looking branding and urgent language like “act fast” or “claim before midnight” to prompt you to act quickly and irrationally. They may even show fake tracking numbers or screenshots of “other winners” to create credibility.

Once you are excited enough to believe the prize is real, the scammer asks you to pay a “processing fee,” taxes, shipping costs, or a small deposit to release the prize. But once you send the money, you’ll never hear from them again.

In a recent Federal Trade Commission report, consumers lost more than $300 million to “prize, sweepstakes, or lottery” type scams. Additionally, adults aged 60 and over are nearly three times as likely to report losses from prize, lottery, or sweepstakes scams compared to younger consumers.

A common variation of this scam involves a message claiming you have a package waiting for you, but you must pay customs fees before it can be delivered.

How to Avoid It

- Know that you never have to pay to receive a prize. Any request for fees, gift cards, or account information is a clear sign of a scam.

- Be cautious of prizes from contests you never entered. If you do not remember signing up, assume it is illegitimate.

- Do not click claim links in unexpected messages. Go directly to the official website or customer support page to check if the prize is real.

- Question urgency. Real sweepstakes will provide you with clear rules and won’t pressure you into immediate action.

10. Healthcare Scams

If you are dealing with a health issue, it is easy to be drawn to anything that sounds like it might help. Scammers exploit this vulnerability by selling fake supplements and treatments. You’ll often see companies offering “miracle treatments” or “secret cures” for serious illnesses. These products may claim to solve chronic pain, memory loss, addiction, or other difficult-to-treat conditions. But in reality, the product lacks scientific evidence and may even interfere with genuine treatments, sometimes causing serious harm.

These scams may show up in email inboxes, on social media, or even as a telemarketing ad.

The FTC warns that dishonest sellers tell you one product will cure multiple diseases, show fake endorsements, promise results in 30 days or less, or insist you must “act now.”

AI tools have made these scams even harder to spot, since scammers can generate fake images or endorsements from trusted figures to make products look legitimate. For example, in 2024, Australian authorities flagged an advertising campaign for “miracle” diabetes supplements that featured a video of an AI-generated doctor endorsing harmful health advice.

How to Avoid It

- Ask your doctor first. Before buying any health product or service, ask your provider if it’s an effective treatment.

- Research the claims. Search for the treatment or product name plus “review,” “complaint,” or “scam.” If you can’t find any credible online, treat it as a scam.

- Check for credible endorsements. Real treatments for diseases will appear in trusted sources like the National Institutes of Health or registered clinical trials.

- Don’t drop proven treatments. Some scams work by convincing people to stop or delay doctor-prescribed medication in favour of their “solution.”

11. Travel Scams

Planning a vacation should be fun, but for some scammers, your excitement is a chance to take advantage. These scams are more common than you might expect; the FTC received over 60,000 travel, vacation, and timeshare-related scam reports in 2023 alone.

A common approach is to promote cheap travel packages or luxury stays that seem like a rare find, when in reality the deal doesn’t exist.

You’ll see posts or emails advertising dream destinations or flight tickets at unbelievably low prices. When you book the package, you’ll be asked to pay a deposit. After you pay, the booking disappears, or the airline tickets turn out to be fake.

The FTC warns that these dishonest offers may ask you to pay via wire transfer, gift cards, or cryptocurrency, which are payment methods that are very hard to recover. What makes these scams tricky to detect is that they may spoof legitimate websites.

How to Avoid It

- Research before you pay. Type the travel company or property name plus words like “review,” “scam,” or “complaint.” If the company has very few or bad reviews, it should raise alarm bells.

- Never pay with wire transfer, gift cards, or crypto. These payment methods are nearly impossible to trace or refund and are very commonly used for scams or fraud.

- Be suspicious of extremely low prices or pressure to act fast. If the deal seems too good to be true, it likely is.

- Use a credit card. Credit cards are the safest payment method and tend to offer better protection against fraud than debit cards, wire transfers, prepaid cards, crypto, or payment apps.

12. Charity Scams

Ever been moved by a heartbreaking story online and wanted to help right away? That’s natural. But scammers count on exactly that generous reaction. Charity scams involve fake organisations or campaigns that ask for donations for disasters, medical emergencies, veterans, or children in need. Unfortunately, the donations end up in the pockets of criminals instead.

For example, in 2024, the FBI’s Internet Crime Complaint Center received over 4,500 complaints, tied to fraudulent charities and disaster-relief campaigns.

Many of these scams are designed to feel urgent. They’ll use wording like “lives depend on your donation”. This tactic is used to get you to “donate” before you verify the organization.

A popular example of this type of scam occurred in 2024 when a man posing as a Catholic priest in New York solicited donations for medical clinics in Lebanon. However, instead of funding aid, he used the more than $650,000 in donations to purchase expensive trips and plastic surgery.

How to Avoid It

- Only donate through trusted organizations. Go directly to a charity’s official website rather than clicking a link in a message or social post.

- Look up the organisation. Confirm registration with tools like CharityNavigator or the IRS nonprofit database.

- Ask questions. It’s not a good sign if the person representing a charity cannot clearly explain the charity’s purpose or how funds are used.

- Be skeptical of peer-to-peer fundraisers. Crowdfunding pages can be totally legit, but scammers often steal photos and stories to create fake campaigns. Verify who set it up and how the funds will reach the intended person or cause.

13. Government Scams

Few scams cause more panic than those involving fake government officials. This is one of the most financially damaging types of impersonation scams. According to the FTC, losses from fraud involving someone claiming to be a government agency have surged in recent years. These cases are especially harmful to seniors, with victims aged 60 and older losing more than $445 million in 2024.

A government scam involves someone reaching out by phone, text, email, or even social media and pretending to be from the IRS, Social Security, or another government agency. They usually claim you owe money and demand immediate payment to avoid fines or arrest.

For example, the email might read:

“URGENT NOTICE! This is the Internal Revenue Service. Your tax filings show you owe an outstanding balance of $1,482. Failure to resolve this matter will result in immediate legal action and possible arrest. To avoid further penalties, send payment via wire transfer today.”

How to Avoid It

- Never pay via gift card, crypto, peer-to-peer app, or wire transfer. Government agencies have secure payment portals and never ask for payments through obscure methods.

- Ask hard questions. A genuine official will provide a company or agency name, badge number, and the right phone number for you to call. If they dodge your questions or give vague answers, that’s a clear red flag.

- Verify independently. Look up the agency’s official website or call it directly using contact information on the website, not the number the caller gives you.

- Keep records of any payments or notices. Real agencies always send official letters or paperwork first, so treat any sudden demand for money as suspicious until you’ve confirmed it’s real.

14. Online Shopping and Marketplace Scams

Imagine this scenario: You see a listing for a “limited-edition designer handbag” at 60% off on a small marketplace site. You pay via direct bank transfer. But after the money leaves your account, the package is never shipped, and the site completely disappears.

This is an example of an online shopping scam, one of the most prevalent types of fraud. In fact, marketplace scams were the second-most-common form of fraud in 2024.

A very common place for these scams to show up is on online marketplaces such as Facebook Marketplace and Craigslist. The informal nature of these platforms makes it easier for scams to occur. Listings can be created in minutes using stolen photos, the scammer can request payment by wire transfer or other non-secure methods, and once a deal is complete, they can vanish with little trace.

How to Avoid It

- Shop and sell through trusted platforms. Stick to reputable online stores and well-known marketplaces that offer buyer protection and secure payment options.

- Watch for red flags in listings. Be wary of vague product descriptions, unrealistic prices, or sellers unwilling to meet in person or via video call.

- Check seller history and reviews. If the seller has no prior sales history or a cluster of short, generic reviews, it’s an indicator of a fake or newly created account.

- Verify the site itself. For online stores, always look for “https://” in the URL, which indicates the website uses encryption to protect your information.

- Trust your instincts. If a deal seems far better than what you’d expect, it usually comes with a catch. Scammers also often pressure you to act fast or move the conversation off-platform.

What to Do If You Suspect a Scam

Think you might’ve been targeted by a scam? Knowing what to do next can make a huge difference. Here’s a quick breakdown of the steps to take to recognize and report a suspected scam.

- Stop all communication. First, halt all communication with the suspected scammer. Don’t reply to any emails, click links, or send additional information.

- Gather as much evidence as you can. You’ll want as much information about the scam as you can get. Save screenshots of emails or other correspondence and write down any phone numbers or payment details they provided.

- Report the scam. Visit reportfraud.ftc.gov as well as the official website of the company or agency being impersonated.

- Change your passwords. Secure your accounts by updating your login credentials and enabling two-factor authentication.

How to Protect Yourself From Future Scams

The best way to avoid the financial fallout of a scam is to protect yourself before it happens. Awareness is your first line of defense; knowing how scams work makes it much harder for scammers to catch you off guard.

Staying safe online shouldn’t require constant guesswork. At Lifeguard, we combine AI-driven protection with education to make online safety accessible. With the right tools, you can stay one step ahead of threats instead of picking up the pieces later.